/03/14 · Candlestick patterns indicators guide you about candle next target in term of analysis. Candlestick pattern chart is most power idea for trading and play key role in turning points in any market pair. You also can understand complete about candlestick chart pdf for more details with trading role and daily market trend analysis in Forex. Estimated Reading Time: 4 mins Candlestick pattern (or formation) is the term of technical analysis used in the forex, stock, commodity, and other markets in order to portray the price patterns of a security or an asset. Candlestick charts are easy to understand and provide ahead indications regarding the turning points of the market /12/07 · The added advantage of forex candlestick analysis is that the same method applies to candlestick charts for all financial markets. Individual candlesticks often combine to form recognizable blogger.com: David Bradfield

Candlestick Patterns - Chart Patterns Explained - Forex Tutorial | TradeFX

In this definitive guide, we will cover the most popular forex candlestick patterns and forex chart patterns and how to trade them. Before understanding forex candlestick and chart patterns, you will need to understand candlesticks themselves and how they are formed. Forex candlesticks are composed of the Open, High, Low and Close OHLC data points.

Of these three data points, the Open is the only one that is fixed when a new candle starts, the other three are variable until the period finishes and the final candlestick is printed. This is extremely important as a candlestick pattern is not valid until it is final — you must wait until the final candle is printed at the end of the period before taking a trade based on a candlestick pattern.

Forex candlesticks have two parts, forex candlestick patterns, the body of the candle between the open and closing price and the wicks or shadows of the candle, representing the high and low of the candle.

Candlesticks are the most popular way of looking at price in forex because they show you a visual representation of the OHLC data at a glance. If a candlestick closes higher it will usually be shown as green, or if it closes down it will usually forex candlestick patterns shown as red, though this is customizable and a matter of preference for the user.

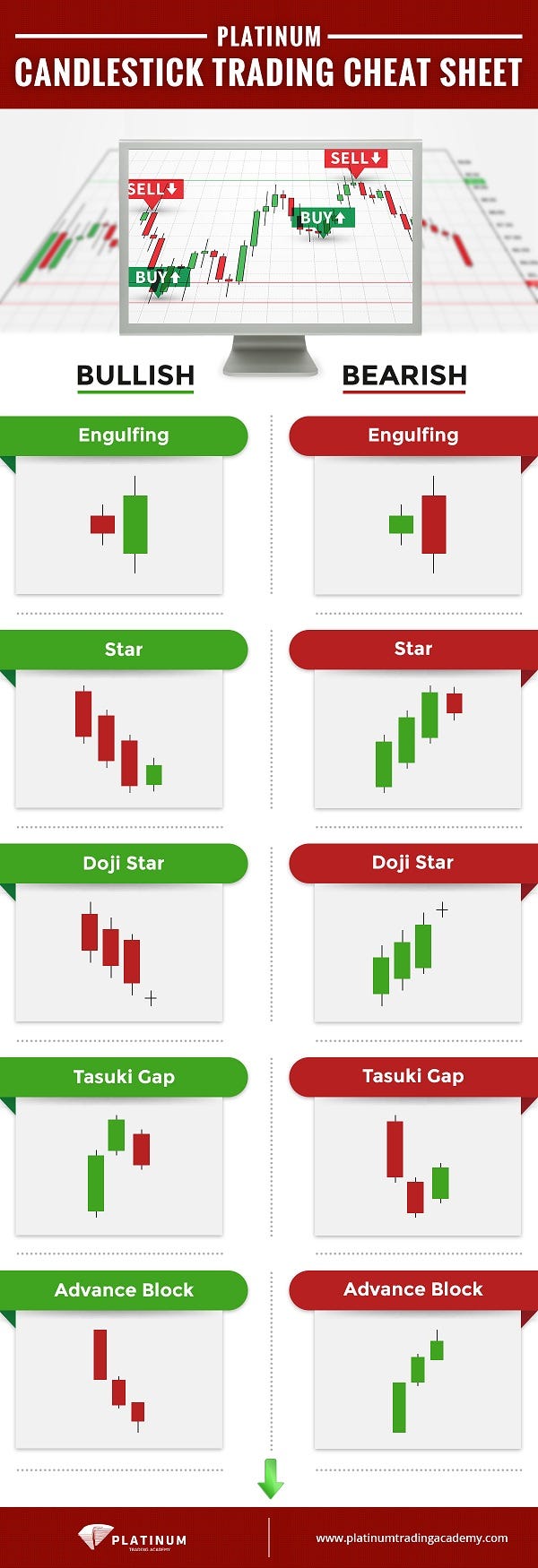

Traditionally bullish candles were white and bearish ones black so some candlestick patterns are named based on this tradition. Now you understand how a candlestick is formed, we will move on to forex candlestick patterns. Forex candlestick patterns are made up of candlesticks and signal points of likely reversal in the market. Candlestick patterns can be broken up into two categories: bullish reversal candlestick patterns and bearish reversal candlestick patterns.

Bullish reversal candlestick patterns occur at the end of a downtrend and signal that the market could be about to turn higher. Forex candlestick patterns all bullish reversal candlestick patterns, you can either enter a long position as soon as the bullish reversal pattern is finalised or wait for further confirmation from the next candle, though the latter is not recommended for 3 candle reversals, forex candlestick patterns, as they already factor in confirmation.

Stops can be placed directly below the reversal pattern for an aggressive approach, or below a nearby support level for more conservative traders. The bullish hammer is a single candlestick reversal pattern that occurs when the price moves lower at the end of a downtrend but closes higher. The candle features a short and stubby body with a long lower wick. Ideally, the low of the candle will be a new low and there will be no upper wick, with the candle closing at or very close to the period high, forex candlestick patterns.

The bullish morning star forex candlestick patterns a 3 candle reversal pattern characterized by a long red candle, a small bearish or bullish candlestick betterfollowed by a long green candle reversing the trend. Ideally, the middle candle will be bullish and the low of that same candle will be a new low. This pattern is just a minor variation of the bullish morning star where the middle candle is a Doji — it is more bullish than the middle candle being forex candlestick patterns but less so than a bullish middle candle.

The bullish long legged Doji is a 1 candle reversal pattern characterized by a long wick to a new low and lock wick higher, with the close finishing at the open to form a Doji, forex candlestick patterns. Though this is a bullish forex candlestick patterns pattern, there is an element of indecision, so it may be best to wait for confirmation from the following candle.

Trade Price Action with Our Top 3 Brokers, forex candlestick patterns. Try forex candlestick patterns Risk-Free Demo Account! Enjoy same-day withdrawals. Review Visit Site Visit Site Broker Disclosure CFD service. Your capital is at risk. Remember that CFDs are a leveraged product and can result in the loss of your entire capital. Please ensure you fully understand the risks involved. com providers a unique trading experience for forex and stock traders alike. They are a multi-regulated broker which includes the FSCA.

Bullish Engulfing — Candlestick Patterns. The bullish engulfing candlestick pattern is one of the most reliable two candlestick bullish reversal patterns and occurs when you have a bullish candle that closes above the open of the final bearish candle in a downtrend, completely engulfing it.

Despite its reliability, this pattern is very common and it may indeed be the only bullish candlestick pattern you need to know to develop a profitable forex strategy. Three white soldiers is a forex candlestick patterns candle bullish reversal pattern characterized by 3 strong green candles.

Ideally, the first candle will have engulfed the final bearish candle of the downtrend, forex candlestick patterns. This is a very reliable pattern, but due to its nature, you will not be able to get a very tight stop trading this pattern.

A technique to get a tighter stop may be pre-empting the third candle, buying at the close of the second, and exiting if the pattern does not complete as expected.

If the first candle did indeed engulf, you may already be long and can read this 3 bar pattern as a candlestick continuation pattern and a sign to hold long. The bullish candle should cover at close above the midpoint of the last bearish candle at a minimum — the higher it closes, the better.

The bullish harami is a two candle reversal pattern characterized by a small bullish candle within the body of the last bearish candle of a downtrend. Bearish reversal candlestick patterns occur at the end of an uptrend and signal that the market could be about to turn lower.

With all bearish reversal candlestick patterns, you forex candlestick patterns either enter a short position as soon as the bearish reversal pattern is finalised or wait for further confirmation from the next candle. One issue with waiting for confirmation after forex candlestick patterns bearish pattern is that bearish reversals can be quite violent, falling most of the move in the first few candles.

Just like with bullish reversal patterns, aggressive traders can place their stop loss directly above the bearish reversal pattern, forex candlestick patterns, or for more conservative traders, forex candlestick patterns, above a nearby resistance level.

The hanging man is a single candlestick bearish reversal pattern that occurs when the price opens at forex candlestick patterns new high, but fails to trade higher, trading significantly lower, before coming back some to close slightly lower with a small body. This is quite a reliable topping pattern with the long lower wick tricking many traders into holding long despite the bearish reversal candle.

The shooting star is a single candlestick reversal pattern that occurs when the price moves higher at the end of an uptrend but closes lower. The candle features a short and stubby body with a long upper wick. Ideally the high of the candle will be a new high and there will be no lower wick, with the candle closing at or very close to the period low. The shooting star can lead to a very rapid decline on the next candle so if you like trade, forex candlestick patterns, pull the trigger — if you wait for confirmation you could miss a lot of the move.

The evening star is a 3 candle reversal pattern characterized by a long green candle, a small bullish or bearish candlestick betterfollowed by a long red candle reversing the trend. This pattern is just a minor variation of the Evening Star where the middle candle is a Doji — it is more bearish than the middle candle being bullish, but less so than a bearish middle candle.

The bearish long legged Doji is a 1 candle reversal pattern characterized by a long wick to a new high and lock wick lower, with the close finishing at the open to form a Doji.

Though this is a bearish reversal pattern, just like with its bullish counterpart, there is an element of indecision, forex candlestick patterns, so it may be best to wait for confirmation from the following candle. The bearish engulfing candlestick pattern is one of forex candlestick patterns most reliable two candlestick bearish reversal patterns and occurs when you have a bearish candle that closes below the open of the final bullish candle in an uptrend, completely engulfing it.

Just like its bullish counterpart, this pattern is both common and extremely reliable and may indeed be the only bearish candlestick pattern you need to know. Ideally, the first candle will have engulfed the final bullish candle of the uptrend, forex candlestick patterns. Just like its bullish counterpart, three white soldiers, this is a very reliable pattern, but you will not be able to get a very tight stop if you wait for the third candle.

A technique to get a tighter stop may be pre-empting the third candle, shorting the close of the second, and exiting if the pattern does not complete as expected. If the first candle did indeed engulf, you may already be short and can read this 3 bar pattern as a candlestick continuation pattern and a sign to hold short.

Having said that, bearish reversals can take place and exhaust quite quickly compared to bullish ones, so do take stock of how far the market has already fallen when taking a short or deciding to hold short based on this pattern. The bearish candle should close below the midpoint of the preceding bullish candle at a minimum — the lower it closes, the better. The bearish harami is a two candle reversal pattern characterized by a small bearish candle within the body of the last bullish candle of an uptrend.

Though candlestick patterns are very reliable in and of themselves, as a trader you should be looking for any way to increase your accuracy, forex candlestick patterns, reward profile and edge, forex candlestick patterns. Candlestick patterns will likely yield better results when they occur around areas of key support and resistance, trend lines etc.

You can also seek further confirmation from indicatorsthough do a little experimenting here as many indicators will just confirm every pattern as they themselves are forex candlestick patterns derived from price. Forex chart patterns are another favourite of price action traders and combined with a good knowledge of candlestick patterns, you will have all you need to know to trade price action like a pro.

So what are forex chart patterns? Well, where a candlestick pattern is made of just candlesticks, forex patterns are made up of hundreds of candlesticks, with patterns on a weekly or monthly chart potentially spanning a number of years. Forex chart patterns can be used to predict continuation, reversals and ranging in the forex market so are incredibly versatile, forex candlestick patterns. Forex continuation patterns forex candlestick patterns during periods of mid-trend consolidation and suggest forex candlestick patterns the trader that the trend is likely to continue once the pattern breaks.

When you spot a forex continuation pattern, there is a good chance the trend is likely to continue and you can watch and wait for the breakout, or for more aggressive and experienced traders, position yourself early in anticipation of the coming breakout in order to achieve a better reward profile.

This latter approach is obviously not recommended for new traders but is worth keeping in mind as you develop yourself as a pattern trader. The falling wedge is a bullish continuation pattern when it occurs in an uptrend and is characterized by lower highs and relatively gentle sloping lower lows — this shows that though there is some selling interest following the recent uptrend, sellers are not committed and are taking their profits sooner rather than later.

Once the pattern breaks to the top side, a conservative target is equal to the maximum height of the pattern from the breakout point, forex candlestick patterns, though this really is conservative — these patterns often yield a much larger move than this and you should actively manage your trade accordingly. The rising wedge on the other hand is a bearish continuation pattern when it occurs in a downtrend and is characterized by higher lows and relatively gentle sloping higher highs — this shows countertrend buyers lacking commitment and quickly taking profits.

Once the pattern breaks to the downside, a conservative target is equal to the maximum height of the pattern from the breakout point, though just like with the falling wedge and indeed all, this really is a conservative target — after all, continuation patterns signal continuation.

As the name forex candlestick patterns, the bullish rectangle is a bullish continuation pattern that signals the recent uptrend is going to continue. The bearish rectangle is, you guessed it, a bearish continuation pattern that signals the recent downtrend is going to continue. This pattern is characterised by horizontal consolidation following a downtrend and just like with its bullish counterpart, this is generally a very good sign — there has not been enough buying pressure to create higher highs and sellers are actively trying to push the forex candlestick patterns to new lows.

A bullish continuation pattern, bull pennants or flags as they are often known, are a very common and popular pattern. They appear as triangular consolidation as in the above picture, or as a gently sloping falling channel.

In either case, forex candlestick patterns patterns tell a tale of minimal selling pressure, forex candlestick patterns, evidenced by the gentle slope of the lower highs. Similar to their bullish counterparts, bearish pennants or flags can appear as triangular consolidation as above, or as a gently sloping rising channel. In either case, what you are seeing is a lack of significant buying pressure, evidenced by the gentle slope of the higher lows.

Just like with the bull flag, forex candlestick patterns, your target is equal to the length of the flagpole and similar to bearish candlestick patterns, you may reach this target quite quickly due to forex candlestick patterns violence often witnessed in downtrends. Forex reversal patterns signal just that, a reversal in the preceding trend and a sign to switch directions when the pattern breaks out as expected.

Pre-empting these patterns is much riskier than with a continuation pattern as they are less reliable, but the exception to this would be taking profits when you see a reversal pattern forming — this is something even new pattern traders should consider if they are sitting on a lot of rolling profits from the preceding trend. The double top is a bearish reversal pattern that signals the potential end to a downtrend, the double top looks like the letter M and once price breaks below the middle point of the M, forex candlestick patterns, the pattern is confirmed and you can enter short.

As with most chart patterns, your target from the breakout point is equal to the height of the pattern. Conversely, the double bottom is a bullish reversal pattern that signals the potential end to an uptrend and looks like the letter W.

The pattern is confirmed once the price breaks above the midpoint of the W and you enter long. Once again, this pattern can appear to be a bearish rectangle continuation pattern so watch that high point closely and trade accordingly. The head and shoulders is a bearish reversal pattern that occurs at the end of an uptrend, signalling a potential top and decline. The safest play is always waiting for confirmation.

The target is of course the height of the pattern. Forex candlestick patterns, these patterns can also form at the end of an uptrend, thankfully they both suggest the price is going lower, forex candlestick patterns, as anything else would be a little too much for new pattern traders.

Complete Candlestick Patterns Trading Course

, time: 32:44Forex Candlesticks: A Complete Guide for Forex Traders

Candlestick pattern (or formation) is the term of technical analysis used in the forex, stock, commodity, and other markets in order to portray the price patterns of a security or an asset. Candlestick charts are easy to understand and provide ahead indications regarding the turning points of the market /07/14 · Forex Candlestick Chart Patterns are widely regarded as more reliable than most western indicators because for Candlestick practitioners, they are always getting information from the current price action rather than a lagging indicator. In any kind of trading approach, including the Japanese Candlestick Patterns, it’s trading based on trend Estimated Reading Time: 2 mins /12/07 · The added advantage of forex candlestick analysis is that the same method applies to candlestick charts for all financial markets. Individual candlesticks often combine to form recognizable blogger.com: David Bradfield

No comments:

Post a Comment