One-Touch Binary Options – The One Touch Binary Options trades are going to close and you will have won when pacing them if at any time during which they are live and in play the value you predicted, either upwards or downwards in value is reached 4. 6. · The price of a binary option, ignoring interest rates, is basically the same as the CDF $\phi(S)$ (or $1-\phi(S)$) of the terminal probability distribution. Generally that terminal distribution will be lognormal from the Black-Scholes model, or close to it. Option price is $$C = e^{-rT} \int_K^\infty \psi(S_T) dS_T$$ for calls and If you are interested in pairing up Bitcoin with other currencies then you are in luck, for we have seen lots of different Binary Option sites allowing their customer to be able to do just that. At this moment in time you are only going to be able to pair Bitcoins with US Dollars, as that is how Bitcoins are usually valued. Commodity Binary Options

Valuation of options - Wikipedia

In this section, I will discuss three examples of widely used exotic options on valuing binary options single index that are path independent, [1] so as to give the reader a better appreciation for some of the mathematical techniques used by practitioners to value these options. Thus, unlike the vanilla call option, this valuing binary options payoff can be written as. To obtain the formula to value this type of a European-style call option,one needs to evaluate the expression.

As can be seen in Table 5, valuing binary options. In the context of BSZ options, since each contract has a lot size ofthe value of the BSZ options can be obtained by multiplying the values in cells B10 and B11 by Thus, to execute an order on BSZ options, the trader has to stipulate the number of contracts associated with that trade.

This is quite different when compared to the binary option transactions in an OTC market since when trading in OTC markets, the trader has to only stipulate the bet amount which acts as a total notional amount associated with the trade. To obtain the formula to value this type of a European-style call option,one needs to evaluate the expression Doing this yields 5, valuing binary options. Binary options do exist as principal- protected note structures. See for example Ravindran b.

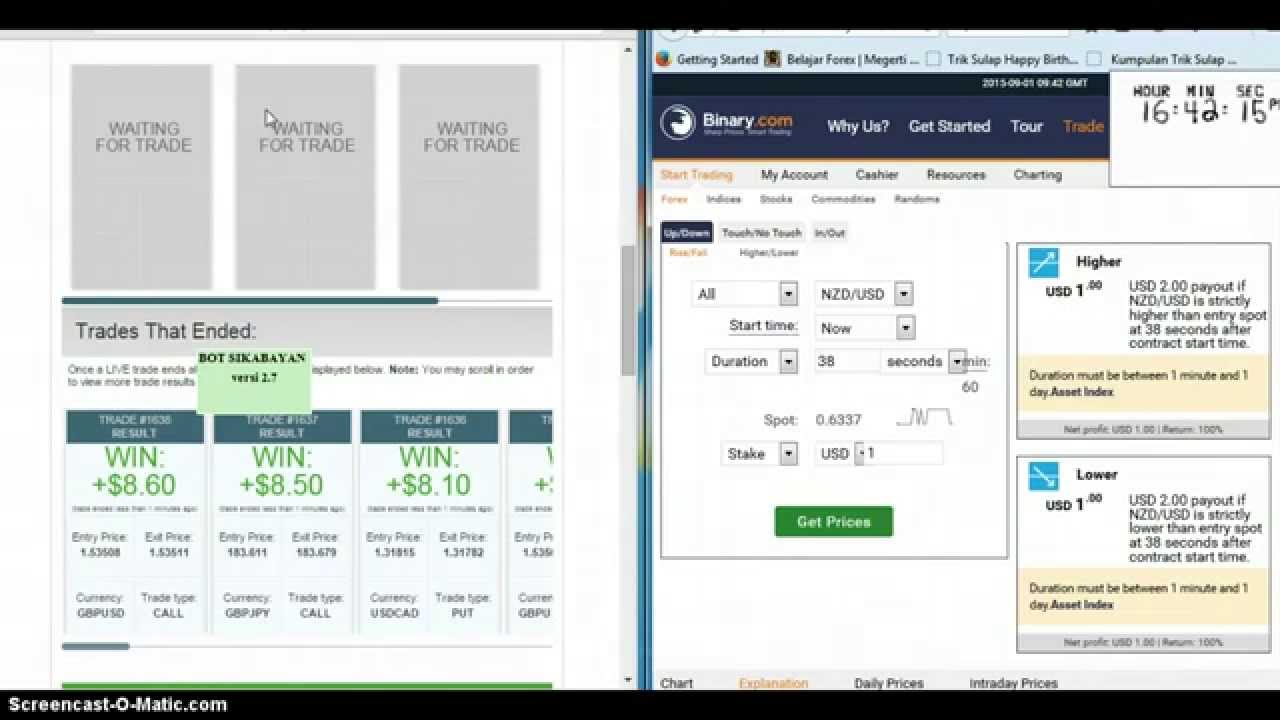

THE BEST BINARY OPTIONS STRATEGY - BINARY TRADING

, time: 8:22Binary option pricing - Breaking Down Finance

4. · The analogous formula for a binary put is given by the expression (b) TABLE Valuation of Binary Options. Table shows the implementation of equations (a) and (b). As can be seen in Table , the values of the call and put options are given respectively by the values of and 1. · designed to value European options, which were dividend-protected. l The value of a call option in the Black-Scholes model can be written as a function of the following variables: S = Current value of the underlying asset K = Strike price of the option t = Life to expiration of the option r = Riskless interest rate corresponding to the life of the option The value of a Binary option can be calculated based on the following method: Step 1: Determine the return μ, the volatility σ, the risk free rate r, the time horizon T and the time step Δt. Step 2: Generate using the formula a price sequence. Step 3: Calculate the payoff of the binary call and, or put and store blogger.comted Reading Time: 2 mins

No comments:

Post a Comment